National Association of Royalty OwnersThe Only National Organization Representing Oil & Gas Royalty Owners Interest |

- Home

|

Free NARO Webinar"How Do I Search for My Deeds and Leases or Other Important Documents"Access Your Free Educational Webinar |

Help support NARO by making a direct donationWe would be very grateful for your direct donation to our National organization. We are a 501 (c) (6) Non Profit, Donations may be deductible as trade or business expenses. Please consult your tax professional for your specific situation. |

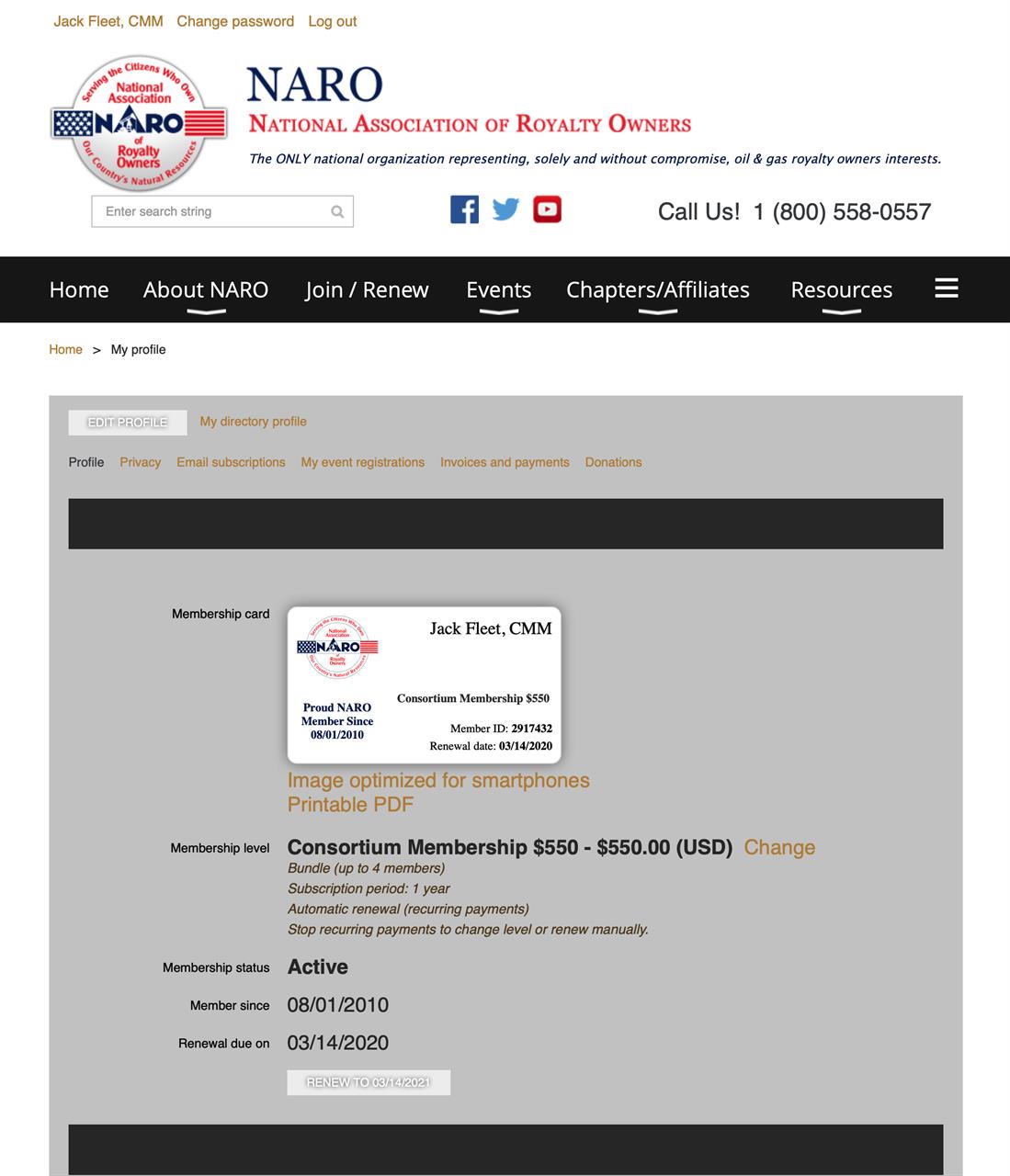

Looking For Your Member Number?Finding It Is EasyMost emails generated through our updated system, have personalized information added to the top banner. This includes your NARO member number, renewal date, type of membership and more! This information is also always available to you in your member profile. To get to your member profile, log in to the NARO website using your email address. Click on your name at the top left portion of your screen. This will open your member profile. There you can view, or print, a membership card, modify your address or email, see when your renewal date is and find your member number! |

|

Many Thanks To Our Advertisers & Supporters

The National Association of Royalty Owners (NARO) does not explicitly or implicitly endorse third parties in exchange for advertising. Advertising on our website or in our monthly newsletter (ROAR) does not influence editorial content, products, services or NARO member services. NARO is a non-profit organization supported by member dues, donations and supporters. If you are interested in advertising on our website, in our monthly newsletter or at a state convention, please call for information about our rates. Help support our education mission. Contact our National Headquarters today.

1-800-558-0557 or naro@naro-us.org

QUESTIONS?

| QUESTIONS AFTER HOURS? |

© Copyright 2022 National Association of Royalty Owners